Prop trading allows traders to access large capital without risking their own money, and futures prop firms make this possible through structured evaluations and clear risk rules. FundingTicks has gained attention for its transparent trading conditions, futures-focused programs, and trader-friendly evaluation structure suitable for both intermediate and experienced traders.

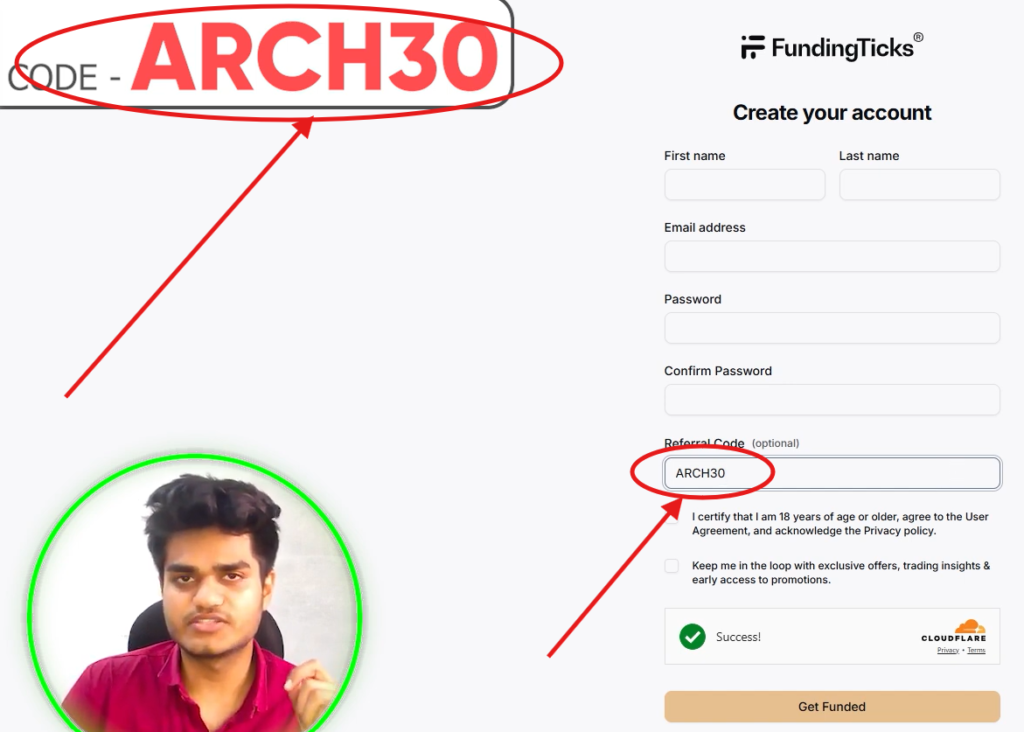

To lower entry costs, traders can use the fundingticks referral code “ARCH30” during signup to get a flat 10% off trading and evaluation fees. This discount helps reduce overall expenses and makes starting funded futures trading with FundingTicks more affordable from day one.

| Field | Value |

|---|---|

| Website Name | FundingTicks |

| Referral / Discount Code | “ARCH30” |

| Code Benefits | Flat 10% off trading and evaluation fees |

| Code Validity | Subject to availability (discount and pricing should be verified at checkout) |

| Referral Link | Click here to join FundingTicks with “ARCH30” |

What Is FundingTicks?

FundingTicks is a futures-focused proprietary trading firm that allows traders to access funded accounts after passing an evaluation phase. Instead of risking personal capital, traders use the firm’s capital and share profits based on predefined rules and performance metrics. In many FundingTicks review discussions, the platform is highlighted for its structured evaluation system and competitive trading conditions.

Futures-Focused Proprietary Trading Firm

Unlike prop firms that specialize in forex or CFDs, FundingTicks is built specifically for futures traders. It supports popular futures instruments and provides rule-based challenges designed to test consistency, risk management, and discipline. Many traders search for the fundingticks referral code to reduce trading fees while joining these evaluation programs.

Who It’s Best For (Beginner vs Experienced Futures Traders)

-

Beginner futures traders benefit from clear rules, defined drawdowns, and a simulated environment to build discipline before scaling capital.

-

Experienced futures traders appreciate the higher capital access, professional trading structure, and reduced personal risk compared to trading their own funds.

Overall, FundingTicks works best for traders who already understand futures markets and want to scale using firm capital.

Difference Between a Prop Firm vs a Broker

-

A prop firm like FundingTicks provides trading capital and earns through profit sharing and evaluation fees.

-

A broker allows you to trade your own money and earns through commissions and spreads.

With a prop firm, risk is limited to fees paid, while brokers expose traders to full market risk on personal funds.

Why FundingTicks Is Popular

FundingTicks has gained popularity due to:

-

Growing demand for futures-only prop trading firms

-

Competitive evaluation models and fee structures

-

Increased visibility through trader communities and FundingTicks review content

-

Traders actively searching for savings via a FundingTicks referral code or discount offers

This has positioned FundingTicks as a strong alternative to well-known firms such as FundedNext among futures traders.

How to Use FundingTicks Referral Code "ARCH30" (Step-by-Step)

Below is a simple step-by-step guide to apply the fundingticks referral code and claim the discount correctly.

Step 1: Visit the official FundingTicks registration page

Go to the official FundingTicks signup page using the FundingTicks Discount Code link:

Create a FundingTicks account with referral code “ARCH30”

Step 2: Create your FundingTicks account

Sign up by entering your basic details and completing the registration process.

Step 3: Referral code “ARCH30” applied automatically

When you register through the referral link, the FundingTicks referral code “ARCH30” is automatically applied—no manual entry is required.

Step 4: Get 10% off trading or evaluation fees

Once the code is active, you receive a flat 10% discount on eligible trading or evaluation-related fees, reducing your overall cost of joining the platform.

Important Note:

FundingTicks pricing, evaluation fees, and discount eligibility may change over time. The exact fee structure and discount application should always be verified on the official FundingTicks website before completing payment. Referral codes provide fee reductions, not guaranteed pricing, and final charges are subject to FundingTicks’ current terms.

FundingTicks Programs Overview

FundingTicks offers multiple trading programs designed to suit different experience levels and risk preferences. Each program follows a distinct funding model, making it important for traders to choose the structure that best aligns with their strategy and goals. This section adds depth to any FundingTicks review and helps traders understand where a fundingticks referral code can be applied effectively.

Pro+ Evaluation Program

The Pro+ Evaluation Program is a subscription-based evaluation model created for traders who prefer flexibility over speed.

Subscription-based evaluation

Traders pay a recurring subscription fee rather than a one-time challenge cost. This allows continued participation as long as the account remains in good standing.

Who should choose Pro+

-

Traders who want more time to pass evaluations

-

Those who prioritize consistency over aggressive trading

-

Futures traders who prefer reduced pressure during evaluations

Time flexibility

There are typically no strict minimum trading days, giving traders freedom to trade at their own pace without rushing trades.

Profit targets and drawdown overview

-

Clear profit targets must be reached to qualify for funding

-

Drawdown rules are strictly enforced to promote risk discipline

-

Emphasis is placed on consistency rather than high-risk gains

This program is popular among traders looking for structure and sustainability rather than quick payouts.

One Program (Single Phase Evaluation)

The One Program is designed for traders seeking a faster route to funded status.

One-step evaluation

Unlike multi-phase challenges, this program requires passing a single evaluation stage, simplifying the qualification process.

Faster path to funding

Successful traders can reach funded accounts more quickly compared to subscription-based models.

Risk and reward balance

-

Higher performance expectations in a shorter timeframe

-

Suitable for confident and experienced futures traders

-

Increased pressure compared to Pro+ but faster capital access

This option appeals to traders who are confident in their strategies and want to minimize evaluation time.

Zero / Instant Funding Program

The Zero (Instant Funding) Program allows traders to bypass evaluations entirely.

Buy a funded account directly

Instead of passing a challenge, traders purchase immediate access to a funded account.

Higher risk, faster payouts

-

No evaluation phase

-

Stricter rules and risk limits

-

Potential for quicker withdrawals

Who this is best for

-

Experienced traders with proven discipline

-

Traders who want immediate capital access

-

Those comfortable with higher upfront costs and tighter rules

This program is not recommended for beginners due to the increased risk and stricter compliance requirements.

Important Note:

Program rules, pricing, profit targets, drawdown limits, and availability may change at any time. Traders should always verify current program details on the official FundingTicks platform before enrolling or making payments. Referral or discount codes reduce fees but do not guarantee fixed pricing or terms.

FundingTicks Pro+ Plus Rules (Detailed Breakdown)

This section focuses specifically on the FundingTicks Pro+ plus rules, one of the most searched topics by traders evaluating the Pro+ program. Understanding these rules clearly is essential for passing the evaluation and avoiding unnecessary account violations.

Profit Target Rules

To pass the Pro+ evaluation, traders must reach a predefined profit target without violating any risk parameters. The profit target is set based on the account size and must be achieved through compliant trading behavior. Large, high-risk trades that reach the target quickly but breach consistency or drawdown rules may still result in failure.

Daily Drawdown

The daily drawdown limits the maximum loss allowed within a single trading day. If the account equity or balance falls below the daily drawdown threshold, the evaluation is immediately failed. This rule encourages controlled risk and prevents overtrading during volatile market conditions.

Trailing Drawdown

The trailing drawdown is one of the most critical FundingTicks Pro+ plus rules. As the account balance increases, the drawdown threshold follows the highest equity level reached. If losses cause the account to fall below the trailing limit, the evaluation is breached—even if the overall account remains profitable.

Traders often fail Pro+ evaluations by misunderstanding how trailing drawdown adjusts with profits.

Consistency Rules

FundingTicks enforces consistency rules to prevent traders from passing evaluations using a single oversized trade. These rules typically require profits to be distributed across multiple trading days rather than concentrated in one session. Consistent performance is prioritized over aggressive short-term gains.

Minimum Trading Days

The Pro+ program requires a minimum number of active trading days before an account can qualify for funding. This ensures traders demonstrate repeatable performance rather than short-term luck.

Trade Duration / Scalping Limitations

Trade duration rules may apply depending on the Pro+ account type. In some cases:

-

Extremely short-duration scalping strategies may be restricted

-

Trades must remain open for a minimum time

-

High-frequency or latency-based trading may be prohibited

Traders should always confirm current scalping or holding-time rules before starting the evaluation.

Why Traders Fail Pro+ Evaluations

Most failures in Pro+ evaluations happen due to:

-

Misunderstanding trailing drawdown behavior

-

Overleveraging to reach profit targets quickly

-

Ignoring daily drawdown limits

-

Violating consistency requirements

-

Not meeting minimum trading day criteria

A careful review of FundingTicks Pro+ plus rules before trading significantly improves pass rates and reduces avoidable violations.

Important Note:

All Pro+ rules, profit targets, drawdown limits, and trading restrictions are subject to change. Traders should verify the latest FundingTicks Pro+ plus rules directly on the official FundingTicks platform before purchasing or trading an evaluation account.

FundingTicks Login – How to Access Your Account

How FundingTicks Login Works

After completing registration, users can access their accounts through the official FundingTicks login page using their registered email and password. Login credentials are created during signup and remain the same across evaluation and funded accounts unless changed manually.

For security reasons, FundingTicks may also apply basic verification or confirmation steps during login, especially when accessing accounts from a new device or location.

Dashboard Overview

Once logged in, traders are redirected to the FundingTicks dashboard, which acts as the central control panel. From the dashboard, users can:

-

View active evaluations or funded accounts

-

Track profit targets, drawdown limits, and rule compliance

-

Monitor account performance and trading statistics

-

Manage subscriptions, billing, and account upgrades

The dashboard is designed to make rule tracking clear, which is especially important for traders following FundingTicks Pro+ plus rules.

Connecting Trading Platforms

FundingTicks supports several professional futures trading platforms. After login, traders can connect their accounts using platform-specific credentials provided inside the dashboard.

Tradovate

A browser-based and desktop futures platform known for ease of use and fast execution. Many beginners prefer Tradovate due to its clean interface.

NinjaTrader

A powerful platform favored by advanced traders for charting, automation, and strategy customization.

TradingView

Used primarily for advanced charting and analysis, TradingView can be connected for executing trades depending on account setup and permissions.

Common Login Issues and Solutions

Incorrect email or password

Ensure the registered email is used. Passwords are case-sensitive. Use the reset option if needed.

Platform credentials not working

Trading platform login details are different from the FundingTicks dashboard login. Always use the credentials shown inside your account dashboard.

Account not visible after login

This can occur if an evaluation has expired or payment was not completed. Check subscription status in the dashboard.

Connection or syncing delays

Occasionally, trading platforms may take time to sync. Logging out and reconnecting the platform usually resolves this issue.

FundingTicks Fees, Profit Split & Payouts

Evaluation Fees Explained

FundingTicks charges evaluation-related fees for most of its programs. These fees grant access to simulated trading accounts where traders must meet profit targets while following strict risk rules. Fees vary depending on:

-

Program type (Pro+, One Program, or Instant Funding)

-

Account size

-

Subscription or one-time payment structure

Many traders reduce these costs by using a fundingticks referral code during signup.

Subscription Model

Some FundingTicks programs, particularly the Pro+ Evaluation, operate on a subscription-based model. Instead of a single upfront fee, traders pay recurring fees to maintain access to the evaluation account. This model:

-

Allows more time to pass the evaluation

-

Reduces pressure from strict time limits

-

Increases total cost if the evaluation takes longer

Subscription pricing and billing cycles should always be verified before purchase.

Profit Split (Up to ~90%)

Once funded, traders are eligible for a profit split that can go up to approximately 90%, depending on the program and account type. This means traders keep the majority of profits generated, while FundingTicks retains a smaller percentage.

Profit split percentages may scale over time or improve after consistent performance.

Payout Frequency

FundingTicks typically offers regular payout cycles, allowing traders to withdraw profits after meeting eligibility requirements. Payout timing depends on:

-

Program rules

-

Minimum profit thresholds

-

Compliance with drawdown and consistency rules

Some programs allow faster withdrawals, while others require longer trading history.

Withdrawal Requirements

Before requesting a payout, traders usually must:

-

Reach the minimum withdrawal amount

-

Complete the required number of trading days

-

Remain within drawdown limits

-

Follow all Pro+ or funded account rules

Failure to meet any requirement can result in delayed or denied withdrawals.

Things That Can Delay Payouts

Common reasons payouts may be delayed include:

-

Rule violations (drawdown, consistency, or trade duration breaches)

-

Incomplete account verification

-

Not meeting minimum trading day requirements

-

Pending review of trading activity

-

Platform or payment processing delays

Carefully following all rules significantly improves payout reliability and speed.

Important Note:

FundingTicks fees, profit splits, payout schedules, and withdrawal rules may change at any time. Traders should always verify the latest terms directly on the official FundingTicks platform before purchasing an evaluation or requesting a payout.

FundingTicks Coupon Code Reddit – What Are Traders Saying?

When traders look up Fundingticks coupon code reddit, they’re usually trying to find real community discussions, experiences, and trust signals before committing to a prop firm. Although FundingTicks doesn’t have a single, official Reddit thread dedicated exclusively to coupons, related crypto- and prop-trading forums reflect the broader sentiment among traders discussing discount codes, referral links, funding experiences, and reliability concerns.

Summary of Reddit Discussions

On Reddit and similar trader forums, threads often focus on:

-

Traders looking for discount or coupon codes to reduce evaluation fees

-

Comparisons with other firms and coupon availability

-

Broader prop-firm feedback where participants mention promotions or community-shared codes rather than official Reddit-verified ones

There isn’t strong evidence of a centralized Reddit thread dedicated solely to FundingTicks coupon codes, but community channels do share referral codes, deals, and sometimes group-exclusive offers.

Positive Feedback Highlights

Some traders report:

-

Active coupon or discount codes being shared in community groups

-

Lower evaluation costs make prop-firm entry more affordable

-

Beginners saving money by using any working FundingTicks discount code found on forums or blogs

-

Occasional payouts being processed without issues in early stages (Kimi)

This kind of positive feedback suggests that coupon codes are one way traders reduce cost barriers, particularly when trialing prop-firm challenges.

Common Complaints

Many of the most vocal online discussions related to FundingTicks—seen more on Trustpilot and forum style reviews than Reddit specifically—highlight several issues:

-

Traders claim rule changes are applied retroactively, affecting accounts mid-trade or after payouts were expected

-

Complaints about slow or denied payouts by some users due to internal rule enforcement

-

Multiple reports of accounts marked “breached” for technical reasons such as IP address issues, which traders say occurred despite no rule violation

While these points aren’t from Reddit exactly, they reflect the kind of community feedback and trader sentiment seen across forums where coupon code discussions appear interwoven with broader experiences.

Rule Change Discussions

Trader communities often discuss the impact of changing evaluation or funded account rules, which can influence how profitable challenges or coupon codes feel in practice:

-

Sudden adjustments to drawdown, scalping rules, or evaluation criteria can diminish perceived value even with a discount

-

Traders warn that coupon codes reduce cost but don’t protect against rule changes that could affect evaluations

This kind of discussion is common in prop-firm subreddits and shows why traders emphasize reading rule updates carefully.

Realistic Expectations

From community posts and reviews:

-

Coupon codes and referral links can meaningfully reduce evaluation fees, making the entry more attainable for new traders

-

However, most trader feedback emphasizes not treating coupon savings as a guarantee of profit or smooth payouts

-

Experienced traders stress understanding the rules and risk management first—discount codes only help with fees, not skill or consistency

Searching for Fundingticks coupon code reddit can yield some community-shared discounts, but always cross-verify any code and check expiration, eligibility, and current terms directly with the official FundingTicks platform.

Important Note:

Online discussions and reviews represent individual opinions and experiences, and availability of coupon codes can change rapidly. Always verify any promo code on the official FundingTicks signup page and validate the current FundingTicks review or support documentation before relying on community posts.

Is FundingTicks Legit or a Scam?

This is one of the most important questions traders ask before signing up. Below is a clear, unbiased breakdown to help readers set realistic expectations about FundingTicks.

Legitimacy Explanation

FundingTicks operates as a futures-focused proprietary trading firm, offering evaluation-based and instant funding programs. Traders pay fees to access simulated or funded accounts and can earn payouts if they follow predefined rules. This business model is common across the prop-firm industry and does not automatically indicate a scam.

FundingTicks provides:

-

Transparent program structures

-

Public rule documentation

-

Defined profit targets and drawdown limits

-

A functional trading dashboard and platform integrations

These elements support its legitimacy as an operating prop firm.

Why It’s Not a Scam

FundingTicks is generally not considered a scam because:

-

Traders are clearly informed they are trading firm capital, not personal brokerage accounts

-

Fees are disclosed upfront

-

Rule violations result in account closure rather than hidden charges

-

Some traders report receiving payouts after meeting requirements

Like other prop firms, FundingTicks earns revenue primarily from evaluation fees and subscriptions, which is standard for the industry.

Why It’s Still Risky

Even though it is legitimate, FundingTicks carries real financial risk:

-

Evaluation fees are non-refundable

-

Most traders fail evaluations due to strict rules

-

Trailing drawdown and consistency rules can eliminate accounts quickly

-

Rule changes or interpretations may affect outcomes

Using a fundingticks referral code lowers costs, but it does not reduce trading risk or guarantee funding or payouts.

Importance of Reading the Rules

Many negative experiences come from traders not fully understanding the rules. This includes:

-

Misinterpreting trailing drawdown behavior

-

Ignoring consistency requirements

-

Violating trade duration or scalping limits

-

Trading aggressively to hit profit targets too fast

Carefully reviewing FundingTicks Pro+ plus rules before trading is essential to avoid preventable failures.

Who Should Avoid FundingTicks

FundingTicks may not be suitable for:

-

Complete beginners with no futures trading experience

-

Traders who dislike strict rule enforcement

-

Those expecting guaranteed payouts

-

Traders unwilling to read and follow detailed trading rules

-

Anyone uncomfortable paying evaluation or subscription fees

For disciplined futures traders who understand prop-firm structures, FundingTicks can be a viable option—but it is not a shortcut to easy profits.

FundingTicks vs FundedNext – Which Is Better?

When traders search for a FundingTicks alternative, FundedNext is frequently mentioned alongside FundingTicks as one of the top futures-oriented prop firms available today. Below is a comparison across key points most traders care about before choosing where to trade.

Evaluation Difficulty

FundedNext offers flexible evaluation models, including rapid and legacy challenges, with fewer restrictions such as no strict daily loss limits and no minimum trading days in some programs. This can make evaluations feel more accessible for traders focused on speed and flexibility.

In contrast, FundingTicks enforces stricter risk rules, including trailing drawdown, daily loss limits, and consistency requirements in its Pro+ and One Program evaluations. These rules ensure risk discipline but can feel more challenging for some traders.

Winner (Ease of Evaluation): FundedNext

Fees

FundedNext typically features a one-time fee structure with no monthly subscription fees for evaluations, helping traders avoid ongoing costs. It also emphasizes no recurring charges and transparent pricing.

FundingTicks, especially in its Pro+ Evaluation Program, can operate on a subscription model, meaning ongoing costs until the evaluation is passed. This can increase overall spending if the evaluation takes time.

Winner (Fee Structure): FundedNext

Profit Split

Both firms offer competitive profit splits once funded:

-

FundedNext can offer profit splits up to around 95%, depending on the account type and performance.

-

FundingTicks also typically provides high profit splits (up to around 90%) after funding, especially in its Zero and One Program models.

Winner (Potential Earnings): Slight edge to FundedNext, based on reported maximum splits.

Rules Strictness

FundingTicks has more traditional prop-firm rules, including daily drawdowns, trailing drawdowns, and consistency requirements—designed to instill discipline but often cited as strict or unforgiving.

FundedNext has some evaluations with minimal restrictions (e.g., no daily loss limits in Rapid challenges) and no time limits on passing, which can be advantageous for some trading styles.

Winner (Trader-Friendly Rules): FundedNext

Best for Futures vs Forex Traders

FundingTicks is primarily focused on futures trading with programs built around futures markets. This makes it appealing for traders who want a structured, futures-specific prop firm.

FundedNext supports both forex and futures markets (and often CFDs), offering greater instrument variety for traders who want flexibility across asset types.

Winner (Versatility Across Markets): FundedNext

Summary Comparison Table

| Feature | FundingTicks | FundedNext |

|---|---|---|

| Evaluation Difficulty | Structured, rule-heavy | Flexible, multiple challenge models |

| Fees | Subscription possible | One-time, no subscription |

| Profit Split | Up to ~90% | Up to ~95% |

| Rules Strictness | Stricter drawdowns & consistency | More flexible options |

| Best For | Futures-only focus | Futures, forex & broader markets |

Final Thoughts

Both FundingTicks and FundedNext are solid prop firm options, but they serve slightly different trader preferences. FundingTicks is structured and rule-oriented, suited for futures traders who prefer a disciplined framework. FundedNext acts as a broader FundingTicks alternative, offering flexible challenge conditions, fewer ongoing fees, and faster access to funding—especially appealing for traders wanting speed and versatility.

Pros and Cons of FundingTicks

Pros

Futures-focused

FundingTicks specializes in futures markets, making it an ideal choice for traders focused on futures contracts rather than forex or other instruments.

Multiple funding options

With Pro+, One Program, and Zero/Instant Funding, traders can choose the program that best matches their experience level and risk tolerance.

High profit split

Once funded, traders can receive a generous share of profits—often up to approximately 90%—enabling strong earning potential for successful traders.

Fast evaluation options

Some programs (like One Program or Zero Funding) offer faster paths to funded status, shortening the time between evaluation and profit sharing.

Referral code discount

Traders can reduce evaluation costs by using a fundingticks referral code like ARCH30, which provides a discount on eligible fees.

Cons

Subscription fees

Certain FundingTicks programs, particularly the Pro+ Evaluation, operate on a subscription model that can increase total costs if the evaluation takes time.

Strict rules

Drawdown limits, consistency requirements, and other FundingTicks Pro+ plus rules can be more stringent than some alternatives, leading to more frequent evaluation failures.

Mixed reviews

Online feedback from community forums and review sites includes both positive payout experiences and complaints about rule interpretations or payout delays.

Not beginner-friendly

Traders new to futures markets or proprietary trading may find the rules and risk management requirements challenging without prior experience.

Who Should Use FundingTicks?

Choosing the right prop firm can make a big difference in your trading journey. Here’s a clear breakdown of who is most likely to benefit from using FundingTicks, and what kind of trader it suits best.

Best Trader Profiles

Futures-Focused Traders

FundingTicks is ideal for traders who prefer futures contracts over forex or stocks. If you specialize in E-mini, micro-futures, or other futures instruments, FundingTicks’ programs are tailored for your needs.

Rule-Driven Traders

Traders who thrive under structured rules—such as drawdown limits, consistency requirements, and profit targets—will find FundingTicks programs aligned with disciplined trading styles.

Skill Level Required

Intermediate to Advanced Traders

FundingTicks is generally better suited for traders who already understand:

-

Futures market mechanics

-

Risk management concepts

-

How drawdown and trailing limits work

Beginners may struggle initially due to strict evaluation rules and the need for consistency over time.

Capital Goals

Growth-Oriented Traders

If your goal is to scale capital without risking your own funds, FundingTicks can be a good option. By passing evaluations and meeting funded account criteria, you can access larger capital allocations while keeping most of your profits.

Profit-Focused, Cost-Conscious Traders

Using a fundingticks referral code like ARCH30 can help reduce evaluation costs, making it more economical to pursue funded account goals.

Strategy Suitability

Trend and Swing Traders

FundingTicks’ consistency and drawdown rules tend to favor strategies that maintain discipline over time rather than rapid, high-risk scalping.

Rule-Compliant Futures Strategies

Any trading strategy that adheres to daily drawdown limits, trailing drawdown parameters, and other FundingTicks Pro+ plus rules can be successful in evaluations.

Avoid highly aggressive or rule-breaking strategies, as they may fail evaluations even if they generate quick profits.

Final Profile Summary

Best suited for:

-

Futures traders with some experience

-

Traders who follow strict risk management

-

Those aiming to scale capital through funded accounts

-

Cost-conscious traders using referral or discount codes

Less suited for:

-

Complete beginners with no futures experience

-

Traders who prefer low-structure environments

-

High-frequency scalpers without strategy compliance

Final Verdict – Should You Join FundingTicks?

After reviewing key aspects of FundingTicks, including programs, rules, fees, and community feedback, here’s a balanced conclusion to help you decide whether it’s right for your trading goals.

Balanced Conclusion

FundingTicks is a legitimate futures-focused proprietary trading firm with multiple evaluation and funded account options. It offers structured programs and high profit splits, making it appealing for disciplined traders who understand risk management. However, its strict rules and potential subscription fees mean it’s not the easiest path for everyone.

Risk vs Reward

-

Reward: High profit split, multiple program paths, cost savings with a referral code, and potential access to significant capital.

-

Risk: Strict evaluation rules, possible recurring fees, and the need for strong futures trading skills.

If you are a trader with a solid understanding of futures, risk discipline, and clear capital goals, FundingTicks can be a strong option. If you are completely new to trading or prefer minimal rules, you may want to build experience first.

Call to Action

Join FundingTicks with Referral Code ARCH30 and Get Flat 10% Off Trading Fees

Use this link to register and have the discount applied automatically:

Sign up with FundingTicks Referral Code “ARCH30”

FAQs About FundingTicks Referral Code "ARCH30"

1. Is FundingTicks referral code “ARCH30” legit?

Yes, “ARCH30″ is a legitimate and active FundingTicks referral code. When used during signup, it provides a flat 10% discount on eligible trading or evaluation fees. The discount is applied automatically when registering through the official FundingTicks referral link.

2. How do I use the FundingTicks referral code “ARCH30”?

To use the code, sign up through the official FundingTicks registration page. When you register using the referral link, “ARCH30″ is applied automatically, and you’ll see the discounted pricing before payment.

3. Can I use “ARCH30” on all FundingTicks programs?

In most cases, the FundingTicks Discount Code “ARCH30” applies to popular programs such as Pro+, One Program, and some instant funding options. However, program eligibility and discounts may vary, so it’s important to verify the final pricing on the checkout page.

4. Does FundingTicks offer instant or zero-evaluation funding?

Yes, FundingTicks offers instant or zero-evaluation funding programs where traders can purchase a funded account directly. These programs typically come with stricter rules and higher upfront costs but offer faster access to payouts.

5. What fees does the 10% discount apply to?

The 10% discount generally applies to:

-

Evaluation or challenge fees

-

Certain account-related trading fees

It does not change profit splits, trading rules, or payout requirements.

6. How long does it take to receive a payout from FundingTicks?

Payout timing depends on the program and compliance with rules. Traders usually need to:

-

Meet minimum profit thresholds

-

Complete required trading days

-

Stay within drawdown and consistency limits

Once eligible, payouts are processed within the firm’s stated payout cycle.

7. Is FundingTicks safe or a scam?

FundingTicks is generally considered legitimate, operating under a standard prop-firm model. Traders pay fees to access evaluations or funded accounts and can withdraw profits if all rules are followed. That said, it still carries risk, and fees are non-refundable.

8. Why do traders fail FundingTicks evaluations?

Most failures occur due to:

-

Trailing drawdown violations

-

Daily drawdown breaches

-

Consistency rule violations

-

Over-leveraging to hit profit targets quickly

Carefully reviewing FundingTicks Pro+ plus rules before trading significantly improves pass rates.

9. Is FundingTicks better than FundedNext?

FundingTicks and FundedNext serve different trader profiles. FundingTicks is more futures-focused and rule-driven, while FundedNext offers broader market access and more flexible evaluations. The better option depends on your trading style and experience.

10. Should beginners use FundingTicks?

FundingTicks is not ideal for complete beginners. It’s better suited for intermediate or advanced futures traders who understand drawdowns, risk management, and rule-based trading environments.